|

| Excerpts of the interview can be found here and a video can be found here. |

Sunday, November 26

On

NBC’s

Meet

The

Press,

Portman

Discusses

Tax

Reform,

Congressional

Ethics

Investigations

&

More

Monday, November 27

After

White

House

Meeting,

Portman

Expresses

Confidence

the

Senate

Will

Approve

the

Tax

Cuts

&

Jobs

Act

“We had a good meeting today and I want to thank the president for supporting our effort to deliver on the promise to cut taxes for middle-class families and reform a broken tax code. I am confident that the Senate will pass this bill and we will have a good bill on the president’s desk before Christmas. Our tax code is long overdue for reform, and it’s critical we get this done to help middle-class families, to help create more jobs, and to increase wages for American workers. Under our plan, a median income Ohio family will save $2,375 annually on their tax bill that they can instead use for gas or groceries, a car payment, retirement, college savings, or a family vacation. I look forward to the debate this week and passing this bill on behalf of middle-class families.”

On

Fox

News,

Portman

Discusses

Meeting

with

President

Trump,

How

Tax

Reform

Will

Help

the

Middle

Class

Ohio family $2,375 annually on their tax bill and help middle-class Ohioans keep more of their paycheck. Portman, who has held six tax reform roundtables in Ohio with local business leaders in recent months, has been vocal on the national stage calling for tax reform, including during recent interviews on Fox News, CNN, CNBC, Bloomberg TV, and NBC’s Meet The Press twice, as well as recently in an op-ed in the Cincinnati Enquirer.

Excerpts can be found here and a video can be found here.

Portman,

Stabenow

Lead

Bipartisan

Great

Lakes

Task

Force

Letter

Highlighting

Importance

of

Finalizing

Critical

Asian

Carp

Study

“It

is

imperative

that

the

USACE

meet

the

original

timeline

for

completing

the

Chief’s

Report

by

January

2019,”

wrote

the

Senators.

“The

USACE

initiated

the

Brandon

Road

Study

in

April

2015

after

the

Great

Lakes

and

Mississippi

River

Basin

Study

(GLMRIS)

identified

the

Brandon

Road

Lock

&

Dam

as

a

location

to

control

the

movement

of

Asian

Carp

into

the

Great

Lakes.”

“USACE

has

indicated

that

implementing

the

recommended

measures

in

the

TSP

is

unlikely

before

2025,”

the

Senators

continued.

“This

timeline

is

particularly

concerning

given

recent

findings

that

demonstrated

new

ways

for

Asian

carp

to

enter

the

Great

Lakes…This

past

June,

an

eight

pound

Silver

carp

made

its

way

up

the

Illinois

River,

beyond

the

Brandon

Road

Lock

and

Dam,

and

was

found

above

the

electric

barrier

–

just

nine

miles

from

Lake

Michigan.”

Tuesday. November 28

On

CBS,

CNN,

&

Fox

Business,

Portman

Discusses

How

Tax

Reform

Will

Boost

the

Middle

Class

In

interviews

on

CBS

This

Morning,

CNN,

and

Fox

Business,

Senator

Portman

again

discussed

how

the

Tax

Cuts

&

Jobs

Act

would save

the

typical

Ohio

family

$2,375

annually

on

their

tax

bill and

help

middle-class

Ohioans

keep

more

of

their

paycheck.

The

CBS

This

Morning

interview

can

be

found

here.

The

Fox

Business

interview

can

be

found

here.

The

CNN

interview

can

be

found

here.

Excerpts

from

the

interviews

can

be

found

here.

Portman,

Brown

Ask

President

to

Prioritize

Reducing

Steel

Overcapacity

Ahead

of

the

Global

Steel

Forum,

Senators

Portman

and

Sherrod

Brown

(D-OH)

asked

the

President

to

prioritize

reducing

steel

overcapacity.

The

Senators

also

urged

the

Administration

to

take

swift

action

on

the

232

investigation,

which

has

been

pending

for

months.

“Until

net

steel

capacity

in

China

and

other

countries

is

reduced,

unfairly

traded

steel

imports

will

continue

to

flood

into

the

U.S.

and

domestic

steel

companies

and

American

steelworkers

will

be

at

risk

for

more

layoffs

and

idled

facilities,”

said

the

Senators

in

their

letter.

Portman and Brown have teamed up to take on unfair foreign trade to boost the steel industry. Their Leveling the Playing Field Act, signed into law in June 2015, has restored strength to antidumping and countervailing duty statutes that allow businesses and workers in the United States to petition the Commerce Department and the International Trade Commission (ITC) when foreign producers, including China, sell goods in the U.S. below market price or receive illegal subsidies. The law led to key wins for Ohio steel companies in major trade cases last year on cold-rolled, hot-rolled, and corrosion-resistant steel, including U.S. Steel, Nucor, ArcelorMittal, and AK Steel, which together employ more than 8,200 Ohio workers.

To read the letter and for more information, go here.

Wednesday, November 29

Portman

on

Senate

Floor:

Tax

Reform

Will

Benefit

Middle

Class

On

the

Senate

floor

on

Wednesday

night,

Portman

discussed

the

Tax

Cuts

&

Jobs

Act,

which

will

reform

our

outdated

tax

code

to

ease

the

burden

on

the

middle

class,

increase

jobs

and

wages

for

workers,

and

encourage

jobs

and

investment

in

America,

not

overseas.

Senator

Portman,

who

met

with

the

president earlier

this

week

to

discuss

tax

reform,

said,

in

part:

“We’re

giving

families

freedom

to spend

more

of

their

own

money how

they

see

fit. We’re

putting

faith

in

American entrepreneurs

and

businesses

to

compete

in

the

global

market.

We’re

bringing

back

some

of

that

money

that’s

locked

out

overseas.

We’re

creating

a

fairer

tax system

that

encourages

jobs

and

investment

here

in

this country

rather

than

overseas.”Transcript of his remarks can be found here and a video can be found here.

On

Fox

Business,

Portman

Discusses

Senate

Tax

Bill,

How

it

Will

Help

Middle

Class

During

an

interview

on

Fox

Business

today,

Senator

Portman

discussed

how

the

Tax

Cuts

&

Jobs

Act

will

help

boost

the

middle

class,

create

more

and

better

jobs,

and

raise

wages.Excerpts can be found here and a video can be found here.

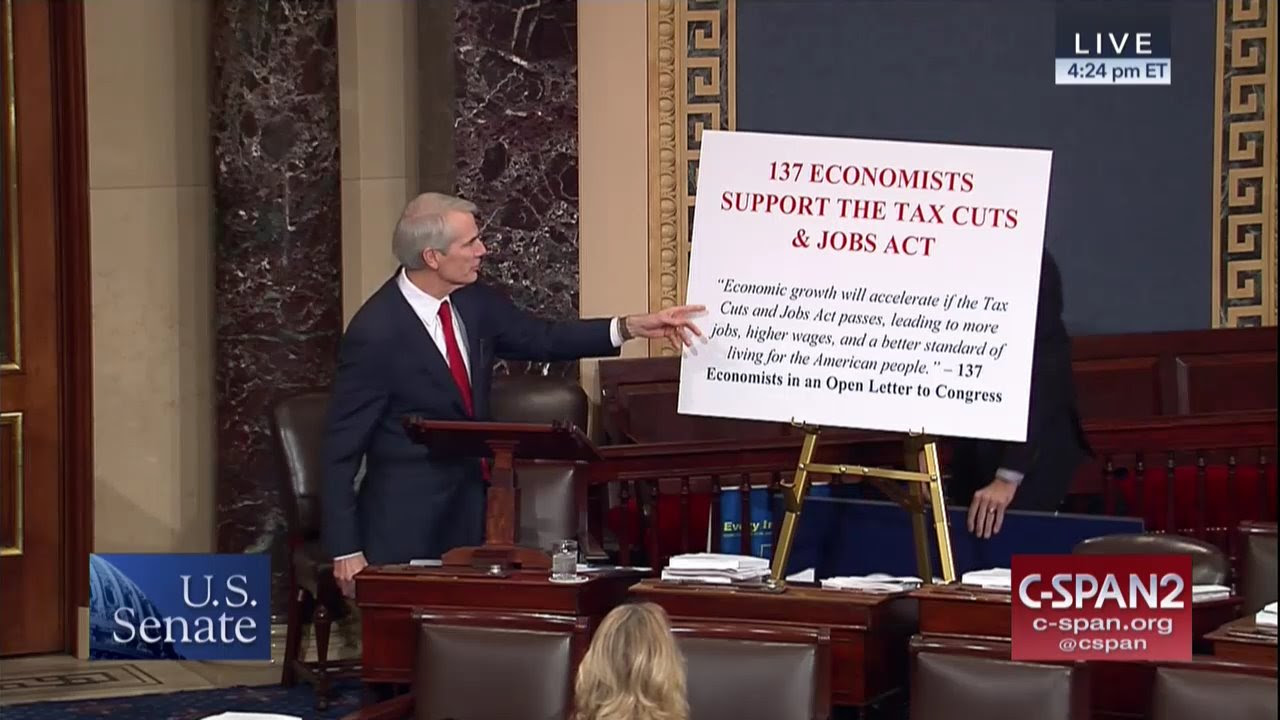

137

Economists

Support

GOP

Tax

Reform

In an open letter to Congress on Wednesday, 137 economists backed the GOP tax reform effort, saying: “Economic growth will accelerate if the Tax Cuts and Jobs Act passes, leading to more jobs, higher wages, and a better standard of living for the American people.” Senator Portman echoed this point on Fox Business earlier in the day, saying the Senate’s Tax Cuts & Jobs Act “will generate more jobs and higher wages because of the increased investment and productivity.”

The full letter can be found at this link.

On

Fox

News,

Portman

Discusses

Bill

to

Help

Stop

Online

Sex

Trafficking,

How

Tax

Reform

Will

Boost

Middle

Class

Senator Portman also discussed how the Tax Cuts & Jobs Act will help boost the middle class, create more and better jobs, and raise wages, including saving the typical Ohio family $2,375 annually on their tax bill and helping middle-class Ohioans keep more of their paycheck.

Excerpts can be found here and a video can be found here.

Thursday, November 30

Portman

on

Senate

Floor:

Tax

Reform

Will

Lead

to

Significant

Economic

Growth

In

a

second

speech

on

the

Senate

floor,

Portman

detailed how

the

Tax

Cuts

&

Jobs

Act

would

help

boost

the

middle

class

and save

the

typical

Ohio

family

$2,375

annually

on

their

tax

bill.

Portman

outlined

how

the

Senate

tax

reform

plan,

which

reforms

our

outdated

tax

code,

would

lead

to

significant

economic

growth

by

encouraging

more

investment

and

job

creation

in

America.

In

his

speech,

Portman

said

that

the

United

States

must

do

better

than

1.9

percent

economic

growth

and

that,

through

tax

reform,

Congress

can

create

the

kind

of

economic

growth

that

will

give

our

economy

a

shot

in

the

arm.Transcript of his remarks can be found here and a video can be found here.

Friday, December 1

On

Senate

Floor,

Portman

Discusses

How

Tax

Reform

Will

Help

Middle-Class

Families

Portman

returned

to

the

Senate

floor

Friday

afternoon

to

discuss

how

the Tax

Cuts

&

Jobs

Act

will

boost

the

middle

class.

Said

Portman

in

his

speech,

the

“middle-class families

who

have

not

seen

an increase

in

their

wages—not just

for

the

last

few

years

but the

last

couple

of

decades—need a

little

help.”

Tax

reform

give

middle-class

families

the

boost

they

need.Transcript of his remarks can be found here and a video can be found here.

Portman

Praises

Senate

Passage

of

Historic

Tax

Reform

Bill

Portman issued the following statement after the Senate passed the Tax Cuts & Jobs Act, which will help middle-class families and save the typical Ohio family $2,375 annually, create more jobs, and increase wages for American workers:

“After

decades

of

talk

and

years

of

planning,

the

Senate

today

passed

landmark

reforms

that

will

provide

tax

relief

for

middle-class

families,

create

more

jobs,

and

increase

wages

for

American

workers,”

said

Portman.

“The

Tax

Cuts

and

Jobs

Act

gives

families

freedom

to

spend

more

of

their

money

how

they

see

fit,

puts

faith

in

American

entrepreneurs

and

businesses

to

compete

in

the

global

market,

and

creates

a

fairer

tax

system

that

encourages

jobs

and

investment

in

the

United

States.

I

was

proud

to

play

a

significant

role

in

developing

this

bill

and

improving

it

on

behalf

of

middle-class

families. I

want

to

commend

Leader

McConnell,

Chairman

Hatch,

and

all

those

involved

in

passing

this

historic

bill

through

the

Senate,

and

I’m

looking

forward

to

resolving

our

differences

with

the

House.

This

is

once-in-a-generation

tax

reform

that

will

improve

our

economy

and

expand

opportunity

for

all

Americans.”

More information on Senator Portman’s work to improve the Senate-passed Tax Cuts & Jobs Act can be found here.

Ohio

Small

Businesses,

Manufacturers,

Farmers

&

Other

Groups

Back

Senate

Tax

Reform

Bill

After

passage

of

the

Tax

Cuts

&

Jobs

Act,

Senator

Portman

highlighted

the

strong

support

from

Ohio

small

business

leaders,

manufacturers,

farmers,

retailers,

restaurants

and

other

state

and

local

organizations

for

this

legislation,

which

is

designed

to

boost

the

middle

class,

increase

jobs

and

wages

for

workers,

and

encourage

jobs

and

investment

in

America,

not

overseas.

You

can

see

what

Ohio

business

leaders

are

saying

about

how

this

bill

will

help

Ohio

workers

and

families

here.On Social Media

Sen. Portman: GOP Has 'Common Goal' of Middle-Class Tax Cuts, Economic Growth

Sen. Rob Portman (R-Ohio) said he and his GOP colleagues are more united on tax reform than they were on repealing ObamaCare.

Portman said he and the rest of the Republican senators will soon meet as a whole to discuss their proposal.

He said there is a lot more unity than there was within the caucus on ObamaCare repeal-and-replace.

"[We have] a common goal... middle class tax cuts and getting this economy moving," he said. "It's great to see the team working together."

(“Sen. Portman: GOP Has 'Common Goal' of Middle-Class Tax Cuts, Economic Growth,” Staff. Fox News. November 27, 2017)

Sea lamprey, other invasive species continue to threaten Great Lakes

Lake Erie is a treasure for Ohio. In addition to being Ohio’s number one tourist destination, Lake Erie provides drinking water for 3 million Ohioans and jobs for hundreds of thousands of families across the Buckeye State. We need to protect this precious resource.…

There is a growing invasive species risk to the Great Lakes that requires attention now. It’s called the sea lamprey.…

I take pride in working with my bipartisan colleagues to support Lake Erie and deliver results for Ohio. Just last year, four of my bills were signed into law to better preserve the Great Lakes, including measures to provide resources to address Flint-like water crises, prevent inappropriate disposal of dredged materials from the Cleveland Harbor, restore fish and wildlife populations, and renew the Great Lakes Restoration Initiative.

We have made progress in this endeavor, but we have much work ahead of us. I want the next generation of Ohioans to fully enjoy and experience the beauty of Lake Erie, and I work every day in Congress to protect the future of our lake.

(“Sea lamprey, other invasive species continue to threaten Great Lakes,” Rob Portman. Toledo Blade.

November 20, 2017

Turning tide of addiction in Ohio

Approximately eight Ohioans a day die from unintentional drug overdoses. Tragically, this has become so prevalent that the Stark County Coroner’s Office, and others across the state, have, at times, run out of space trying to keep up with overdose deaths.

There are an estimated 200,000 Ohioans suffering from opioid addiction — a number roughly equal to the city of Akron’s population.

Addiction affects Ohioans regardless of age, area code or economic status. While we have made some progress, we must continue developing better strategies to turn the tide of addiction in our communities.

During recent trips to Ohio recovery homes and treatment centers, I have seen new approaches that treat the root of addiction rather than just the immediate symptoms…

(“Turning tide of addiction in Ohio,” Rob Portman. Canton Repository. November 20, 2017)

Sen. Portman: Both Parties 'Want to Get to Yes' on Tax Reform

Republicans and Democrats both "want to get to yes" on the Senate's tax reform bill, Sen. Rob Portman, R-Ohio, said Tuesday.

"I think about 90 percent of Republicans who've said they are supportive of it, in fact strongly supportive, and then we've got some folks who are still looking at various aspects, but they all want to get to yes, they all want middle class tax cuts, they all want simplification, they all want the pro-growth policies," Portman told "CBS This Morning."

(“Sen. Portman: Both Parties 'Want to Get to Yes' on Tax Reform,” Joe Crowe. NewsMax. November 28, 2017)

No comments:

Post a Comment

The South Central Bulldog reserves the right to reject any comment for any reason, without explanation.