|

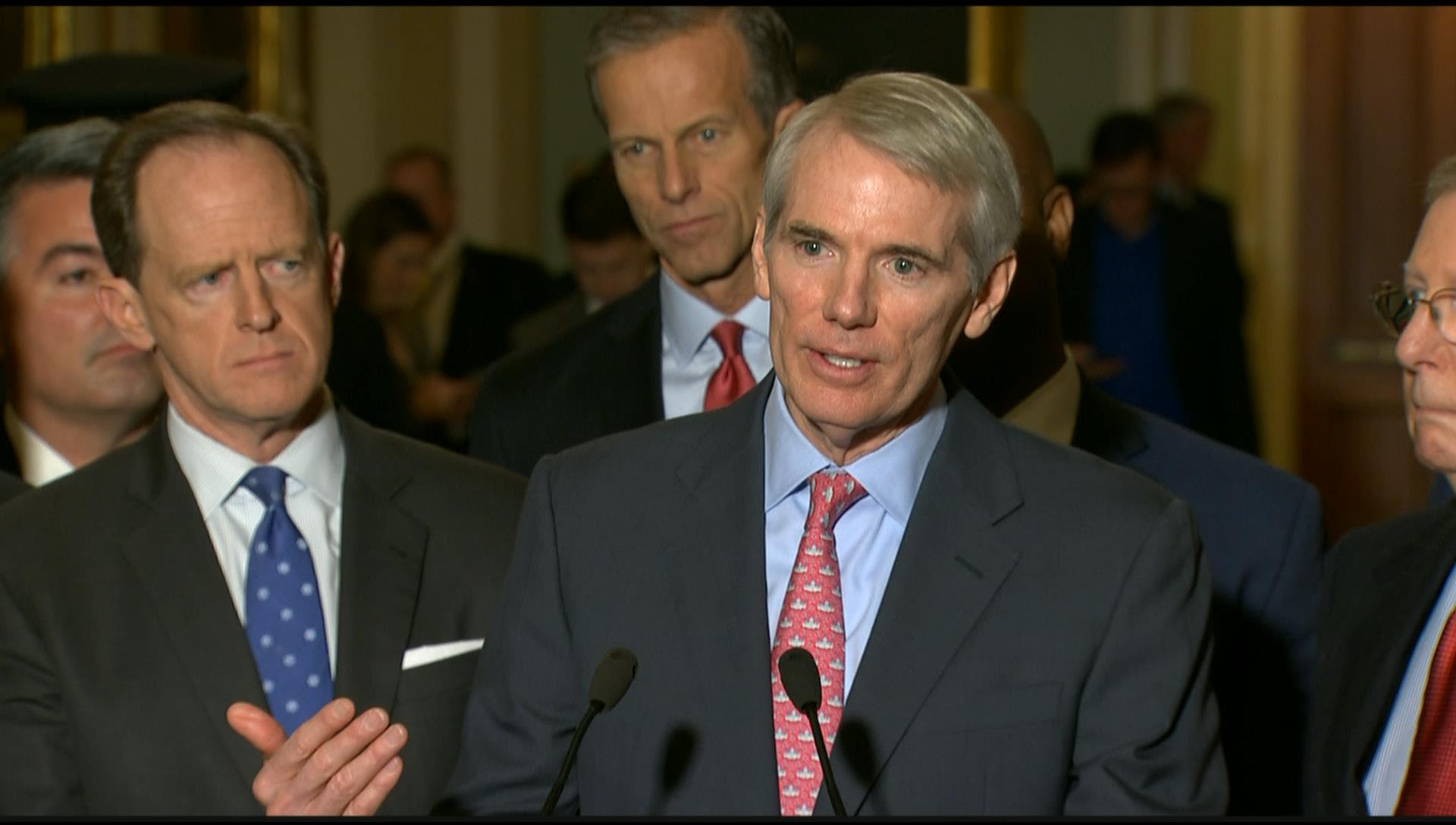

| Senator Portman |

Notably, the legislation would save the typical Ohio family $2,375 annually on their tax bill. That’s $2,375 for Ohio families to use more of their own money for groceries, gas, a car payment, retirement and college costs, a family vacation, or whatever they choose, and that’s why Portman is working so hard to get this legislation signed into law. Also this week, Portman saw his legislation to provide additional funding to the 180th Fighter Wing in Toledo, the JSMC in Lima, and the Wright-Patterson Air Force Base in Dayton pass through Congress as part of the FY 2018 National Defense Authorization Act (NDAA) Conference Report. It now heads the president’s desk for his signature.

For more on Senator Portman’s week, please see the following:

Saturday,

November

11

On

Saturday,

Senator

Portman

received

the

Panetta

Institute

for

Public

Policy’s

bipartisan Lincoln-Jefferson

Award.

The

Panetta

Institute

bestowed

this

prestigious

award

upon

Senator

Portman

and

Senator

Jack

Reed

(D-RI)

to

honor

their

exceptional

commitment

to

the

principles

of

our

democracy

and

dedication

to

encouraging

the

healthy

function

of

the

United

States

system

of

government

through

an

informed

electorate.

“I

am

humbled

to receivethe

Panetta

Institute’s

2017

Jefferson-Lincoln

Award,” said

Portman.

“My

focus

each

and

every

day

is

to

work

with my

bipartisan

colleagues

to

get

things

done for

Ohio in

the

Senate.

The

issues

facing

the

American

people

aren’t

dependent

upon

political

affiliation,

and

the

solutions

shouldn’t

be

either.

Whether

it

is

reforming

our

broken

tax

code

to

bring

more

jobs

back

to

America

and

increase

wages,

turning

the

tide

of

the

opioid

epidemic,

or

ending

the

heinous

crime

of

sex

trafficking,

I will continue to

work in

a

bipartisan

manner

to

deliver

results

and

get

meaningful

legislation

passed

for

the

people

of

Ohio.”

“In

presenting

the

Jefferson-Lincoln

Awards,

the

Panetta

Institute

recognizes

individuals

who

have

dedicated

their

careers

to

the

most

vital

principles

of

our

democracy,”

said Secretary

Leon

E.

Panetta.

“In

presenting

these

awards

annually,

we

pay

tribute

to

those

leaders

who

are

committed

to

the

principles

that

have

historically

made

our

country

an

inspirational

example

of

the

democratic

process

at

its

best.”

Portman was also ranked the third most bipartisan member of the Senate in 2017 by the Lugar Center’s Bipartisan Index.

Portman received two other bipartisan awards last week. On Tuesday, he received the Jacob K. Javits Prize for Bipartisan Leadership, and on Wednesday, he and his wife, Jane, received the National Organization on Fetal Alcohol Syndrome’s bipartisan Leadership Award.

Monday, November 13

Independent

Tax

Foundation

Says

Ohio

Families

Will

Save

$2,375

Annually

Under

Senate

Tax

Reform

Plan

“The

tax

code

is

hopelessly

broken.

For

the

middle

class

in

Ohio,

a

median

income

family

will

save

$2,375

per

family.

That

helps

right

now

because

people’s

salaries

are

flat.

Wages

are

flat

and

yet

expenses

are

up.”

The

Senate’s

plan

to

rewrite

the

tax

code

would

go

much

further

than

a

competing

House

proposal

toward

making

good

on

Republican

promises

to

focus

on

the

middle

class,

a

new

report

shows.

Moderate-income

people

would

consistently

see

the

largest

percentage

declines

in

their

tax

bills,

according

to

an

analysis

released

late

Saturday

by

the

official,

nonpartisan

Joint

Committee

on

Taxation.

Portman

in

Senate

Finance

Committee:

Time

is

Now

to

Pass

Tax

Reform

to

Create

Jobs

&

Boost

Wages

The Senate Finance Committee began consideration of the Tax Cuts & Jobs Act, legislation designed to help the middle class, create more jobs, and increase wages for American workers on Monday. Portman delivered opening remarks detailing today on how the bill would save the typical Ohio family $2,375 annually on their tax bill and help middle class Ohioans keep more of their paychecks. Portman also discussed tax reform on Fox News and Fox Business earlier in the day.

Transcript can be found here and a video can be found here.

Tuesday, November 14

Portman:

Tax

Reform

is

About

Helping

the

Middle

Class,

Creating

Jobs,

and

Boosting

Wages

During

a

Senate

GOP

press

conference

on

tax

reform,

Portman

discussed

how

the

Tax

Cuts

&

Jobs

Act

will

help

the

middle

class,

create

more

jobs,

and

increase

wages

for

American

workers.Specifically, Portman noted how the bill would save the typical Ohio family $2,375 annually on their tax bill and help middle class Ohioans keep more of their paychecks. Portman, who has held six tax reform roundtables in Ohio with local business leaders in recent months, has been vocal on the national stage calling for tax reform, including during recent interviews on Fox News, CNN, CNBC, Fox Business, Bloomberg TV, and NBC’s Meet The Press, as well as recently in an op-ed in the Cincinnati Enquirer.

Transcript can be found here and a video can be found here.

Wednesday, November 15

Portman’s

Bipartisan

Stop

Taxing

Death

and

Disability

Act

Included

in

Senate

Tax

Reform

Bill

On

Wednesday,

Portman

announced

that

his

Stop

Taxing

Death

and

Disability

Act,

legislation

he

introduced

earlier

this

year

with

Senators

Chris

Coons

(D-DE)

and

Angus

King

(I-ME),

has

been

included

in

the

Senate

tax

reform

bill.

The

bill

is

designed

to

eliminate

a

tax

penalty

levied

on

student

loans

forgiven

for

families

after

the

death

of

their

child

and

Americans

who

develop

permanent

disabilities.

The

bill

also

allows

a

parent

whose

child

develops

a

total

and

permanent

disability

to

qualify

for

student

loan

discharge.

Congressman

Peter

Roskam

(R-IL)

and

Ron

Kind

(D-WI)

introduced

a

companion

bill

in

the

House. Portman

discussed

the

legislation

on

Fox

News

earlier

this

year

with

Senator

Coons.While the federal government forgives certain federal student loans in the case of the death or disability of the borrower, the IRS treats this cancelled debt as income, which can result in tens of thousands of dollars in immediate tax liability. The Stop Taxing Death and Disability Act would eliminate this unfair tax, which simply replaces one financial burden with another and serves no public policy purpose. The tax on discharged loans is not only an unnecessary tax, but it also prevents the Department of Education from streamlining the loan forgiveness process.

Portman’s interest in this issue was spurred by the outreach from constituents in Ohio who were facing the consequences of this misguided policy.

“Families

like

the

Carducci

family

of

Steubenville,

Ohio,

who

have

a

child

who

has

become

permanently

and

totally

disabled

are

going

through

unimaginable

grief,”

Portman

said.

“Because

of

this

tragic

disability,

they

cannot

afford

a

massive

student

loan

bill.

Other

families

have

a

lost

a

child,

and

are

forced

to

pay

a

significant

tax

penalty,

sometimes

of

tens

of

thousands

of

dollars,

on

forgiven

student

loans

while

they

are

still

grieving.

The

last

thing

that

families

in

these

situations

need

is

that

kind

of

financial

burden.

I

am

pleased

this

bill

has

been

included

as

part

of

the

Senate

tax

reform

plan.

I

hope

to

see

it

signed

into

law

soon

to

provide

relief

to

these

families

at

a

difficult

time.”

At

Finance

Hearing,

Portman

Discusses

Updates

to

Senate

Tax

Reform

Bill,

Inclusion

of

the

Stop

Taxing

Death

and

Disability

Act

Transcript can be found here and a video can be found here.

Portman:

“1.9

Percent

Economic

Growth

Are

You

Kidding

Me?

We

Can

Do

Better

Than

That”

At the Senate Finance Committee consideration of the Tax Cuts & Jobs Act, Portman outlined why the Senate must act on tax reform. In addition to discussing the inclusion on the Stop Taxing Death and Disability Act earlier in the day, Portman also discussed how the bill would save the typical Ohio family $2,375 annually on their tax bill and help middle-class Ohioans keep more of their paycheck.

Transcript can be found here and a video can be found here

Thursday, November 16

Portman

Praises

Senate

Finance

Committee

Approval

of

the

Tax

Cuts

&

Jobs

Act

Thursday

night,

Portman

praised

Senate

Finance

Committee

approval

of

the Tax

Cuts

&

Jobs

Act,

the

Senate

tax

reform

proposal

that

will

help

the

middle

class,

create

more

jobs,

and

increase

wages

for

American

workers.

A

summary

of

the

plan

can

be

found here. Portman

issued

the

following

statement:

“Today’s

vote

marks

an

important

step

forward

in

our

effort

to

provide

tax

relief

to

the

middle

class,

grow

our

economy

and

create

more

jobs,

and

increase

wages

for

American

workers.

I’m

pleased

that

we’ve

had

an

open

process

with

70

tax

reform

hearings

since

2011

and

a

four-day

markup

where

every

committee

member

had

the

opportunity

to

offer

amendments.

Every

member

will

continue

to

have

the

opportunity

to

have

their

voice

heard

when

the

full

Senate

begins

consideration

of

this

bill.

“Our

tax

reform

plan

is

focused

on

providing

middle-class

tax

relief

to

help

Ohio

families

who

are

dealing

with

this

middle-class

squeeze

of

higher

expenses

and

flat

wages.

Under

our

plan,

a

median

income

Ohio

family

will

save

$2,375

annually

on

their

tax

bill

that

they

can

instead

use

for

gas

or

groceries,

a

car

payment,

retirement,

college

savings,

or

a

family

vacation.

Our

plan

will

help

make

American

companies

more

competitive

so

we

can

create

more

jobs

and

increase

wages

in

the

United

States

rather

than

sending

them

overseas. Our

plan

will

also

level

the

playing

field

internationally

so

we

can

bring

back

jobs

and

investment.

It’s

been

31

years

since

we’ve

reformed

our

outdated

tax

code.

I

commend

the

House,

Speaker

Ryan,

and

Chairman

Brady

for

passing

their

tax

reform

bill

today.

It’s

time

for

the

full

Senate

to

follow

suit

and

act

on

behalf

of

middle-class

families.”

Following

Portman

Request,

Congress

Authorizes

$15

Million

for

New

Toledo

Air

Base

Hangars

Portman

announced

that

the

Senate

has

passed

the

FY

2018

National

Defense

Authorization

Act

(NDAA)

Conference

Report,

which

authorizes $15

million

to

support

the

construction

of

upgraded

fighter

aircraft

hangars

for

the

180th

Fighter

Wing

in

Toledo,

Ohio.

Senate

Armed

Services

Chairman

John

McCain

(R-AZ)

and

Ranking

Member

Jack

Reed

(D-RI)

included this

funding

after

Portman

sent

a

letter

earlier

this

year

urging

them

to

do

so.

The

180th

Fighter

Wing,

which

Portman

visited just

earlier

this

year

as

part

of

his

Ohio

Defense

Tour,

carries

out

the

critical

Aerospace

Control

Alert

(ACA)

mission

to

protect

America’s

airspace.

“I

have

seen

firsthand

how

our

Airmen

at

the

180th

Fighter

Wing

in

Toledo

are

carrying

out

one

of

our

nation’s

most

important

homeland

defense

missions:

protecting

our

skies

through

the

Aerospace

Control

Alert,”

said

Portman.

“Defending

the

homeland

remains

the

number

one

national

security

mission

for

our

military,

so

it

is

critical

that

the

180th

Fighter

Wing

in

Toledo

has

the

best

equipment

available.

The

current

ACA

hangars

are

outdated

and

don’t

provide

the

protection

needed

for

the

aircraft

and

the

airmen

maintaining

them.

These

outdated

hangers

must

be

replaced,

and

I

am

pleased

that

Congress

is

authorizing

funding

to

upgrade

them.

I

urge

the

president

to

sign

this

measure

into

law

to

ensure

that

the

men

and

women

serving

our

country

in

Toledo,

and

around

the

world,

have

the

resources

they

need.”

Portman

Announces

Congress’

Approval

of

Funding

to

Modernize

Stryker

Vehicles,

Increase

Production

of

Abrams

Tanks

“In

this

heightened

global

security

environment,

we

need

to

ensure

our

soldiers

have

the

proper

resources

and

tools

necessary

to

carry

out

their

critical

missions,”

said

Portman.

“The

Joint

Systems

Manufacturing

Center

(JSMC)

in

Lima

is

now

producing

the

latest-generation

Abrams

tank

and

Stryker

vehicles,

the

Army’s

most

versatile

and

deployable

combat

vehicle.

The

funding

provided

in

the

NDAA

will

allow

JSMC

to

increase

the

rate

of

production

of

the

newest

Abrams

tank

and

make

needed

upgrades

to

Stryker

vehicles.

The

work

done

at

JSMC

boosts

Lima’s

economy—and

provides

critical

national

security

assets

that

strengthen

our

military

resolve.

I

am

pleased

that

this

funding

will

support

the

skilled

JSMC

employees

I

met

with

in

August.

I

look

forward

to

the

president

signing

this

legislation

to

bolster

our

military

and

allow

JSMC

to

continue

assisting

our

men

and

women

in uniform.”

Senate

Passes

Portman,

Brown

Amendments

to

Support

Jobs

&

Research

at

Wright-Patt’s

Air

Force

Research

Lab

“The

innovative

research

and

development

conducted

at

the

Air

Force

Research

Lab

at

Wright-Patt

is

critical

to

our

national

security

and

to

maintaining

our

military’s

technological

edge,”

said

Portman.

“I

will

continue

to

work

with

Senator

Brown

to

support

Wright-Patt

and

ensure

that

its

highly-skilled

workforce

has

the

tools

and

resources

it

needs

to

carry

out

its

missions.”

Portman

Announces

Final

Passage

of

Ukraine

Security

Assistance

Amendment

in

NDAA

Conference

Report

“There

is

longstanding

bipartisan

agreement

on

the

policy

tools

that

the

United

States

should

utilize

as

part

of

its

comprehensive

strategy

to

support

Ukraine,

deter

future

aggression

against

our

allies

and

interests,

and

uphold

the

fundamental

principles

of

the

U.S.-led

international

system

that

Russia’s

actions

ultimately

threaten.

Now,

the

United

States

Senate

is

taking

a

critical

step

forward

in

its

support

for

Ukraine,”

said

Senator

Portman.

“As

Russian

aggression

in

eastern

Ukraine

persists,

and

as

it

continues

to

utilize

hybrid

warfare

techniques

such

as

propaganda

and

disinformation,

it

is

critical

that

the

U.S.

and

NATO

provide

the

sustained

economic,

political,

and

military

support

necessary

to

allow

Ukraine

to

secure

its

democratic

future.

An

independent

Ukraine

is

critical

not

just

to

Eastern

Europe,

but

it

also

impacts

broader

U.S.

interests

in

the

region

and

beyond.

I

urge

the

president

to

sign

this

measure

into

law

quickly

to

get

Ukraine

the

assistance

they

need.”

Portman,

Murphy

Announce

Final

Passage

of

Measure

to

Counter

Foreign

Propaganda

in

NDAA

Conference

Report

“Last

year,

the

United

States

took

a

critical

step

towards

confronting

the

extensive,

and

destabilizing,

foreign

propaganda

and

disinformation

operations

being

waged

against

us

by

our

foreign

adversaries

by

passing

the

bipartisan

Countering

Foreign

Propaganda

and

Disinformation

Act.

And

today

marks

another

step

forward,”

said

Senator

Portman.

“By

better

coordinating

and

synchronizing

our

government’s

response

to

foreign

propaganda

and

disinformation,

the

United

States

will

be

more

successful

in

ensuring

that

our

ideas

win.

I

am

confident

that,

with

the

help

of

our

bipartisan

bill

and

proper

coordination

between

government

agencies,

the

disinformation

and

propaganda

used

against

us,

our

allies,

and

our

interests

will

fail.

I

urge

the

President

to

sign

this

measure

immediately.”

Friday, November 17

Portman

on

Fox

News:

Democrats

Have

Been

Talking

About

Middle

Class

Tax

Cuts

But

Republicans

Are

Delivering

It

Transcript can be found here and a video can be found here.

On Social Media

Senate Needs to Pass the Stop Enabling Sex Traffickers Act

The Stop Enabling Sex Traffickers Act has unanimously cleared a Senate committee with bipartisan support.

The full Senate should quickly move to pass the bill, which would allow victims to get justice and would give law enforcement a valuable tool in reining in the trafficking of children and young women on the Internet.

SESTA has been championed by Sen. Rob Portman (R., Ohio) since a two-year Senate investigation revealed that classified advertising website Backpage.com has been facilitating sex trafficking for years.

The National Center for Missing & Exploited Children reported that an explosion in Internet ads led to an 846 percent increase in suspected child sex trafficking from 2010 to 2015. Backpage, according to an industry report, is the recipient of $8 of every $10 spent on online commercial sex advertising…

(“Senate Needs to Pass the Stop Enabling Sex Traffickers Act, Editorial. Toledo Blade. November 13, 2017)

JSMC gets over $2 billion in additional defense funding

The Fiscal Year 2018 National Defense Authorization Act has passed the U.S. Senate and will now go to the president for signature.

The NDAA includes over $1.6 billion in funding to upgrade the Abrams tank at Lima’s Joint Systems Manufacturing Center, including cutting edge survivability equipment, according to Sen. Rob Portman, R-Ohio, along with $622 million to complete the fourth Stryker brigade, providing survivability and mobility improvements.

“The funding provided in the NDAA will allow JSMC to increase the rate of production of the newest Abrams tank and make needed upgrades to Stryker vehicles,” Portman said. “The work done at JSMC boosts Lima’s economy — and provides critical national security assets that strengthen our military resolve.”

(“JSMC gets over $2 billion in additional defense funding,” Staff. Lima News. November 17, 2017)

Craft breweries could get big break under Senate tax plan

Congress may soon give craft brewers a big tax break. Part of the Senate tax reform plan includes cutting the federal excise tax in half.

For craft brewers like North High Brewing Company, cutting the excise tax in half would lower its tax bill by $20,000.

"There's tons of projects we can spend $20,000 on right now but we don't have that $20,000 in the bank right now," said Tim Ward with North High Brewing….

Democrats and Republicans have been working on a bill to cut the excise tax. Sen. Rob Portman worked with Oregon Democrat Ron Wyden to add that legislation to the tax reform plan. Republicans are trying to pass tax reform by the end of the year.

(“Craft breweries could get big break under Senate tax plan,” Ben Garabek. Columbus ABC 6. November 16, 2017)

No comments:

Post a Comment

The South Central Bulldog reserves the right to reject any comment for any reason, without explanation.