Senator

Portman

is

hitting

the

ground

running

to

start

the

New

Year,

continuing

his

work

to

deliver

for

Ohio

workers

and

families.

After

playing

a

key

role

in

getting

the

historic

Tax

Cuts

&

Jobs

Act

signed

into

law

last

month,

Portman

visited

Sheffer

Corporation

in

Cincinnati

on

Tuesday,

where

it

announced

new

investments

in

its

plants

and

equipment

and

that

all

126

Sheffer

employees

would

receive

bonuses

due

to

tax

reform,

and

Wolf

Metals

in

Columbus

on

Friday,

where

new

investments

in

equipment

were

announced.

Also

this

week,

Portman

visited

Healing

Hearts

in

Mansfield

and

the

Alvis

House

in

Columbus

to

hear

from

those

battling

addiction

and

re-entering

society

from

the

criminal

justice

system—as

well

as

those

on

the

frontlines

working

to

assist

in

recovery

efforts.

Also

this

week,

Portman

introduced

the

Fallen

Warrior

Battlefield

Cross

Memorial

Act

to

help

ensure

that

veterans

buried

in

Ohio

and

around

the

country

can

be

properly

honored

with

the

Battlefield

Cross.

For

a

more

detailed

look

at

Senator

Portman’s

week,

please

see

the

following,

and,

in

case

you

missed

it,

here is

a

rundown

of

Senator

Portman’s

record

of

delivering

results

for

Ohioans

in

2017.

Senator

Portman

is

hitting

the

ground

running

to

start

the

New

Year,

continuing

his

work

to

deliver

for

Ohio

workers

and

families.

After

playing

a

key

role

in

getting

the

historic

Tax

Cuts

&

Jobs

Act

signed

into

law

last

month,

Portman

visited

Sheffer

Corporation

in

Cincinnati

on

Tuesday,

where

it

announced

new

investments

in

its

plants

and

equipment

and

that

all

126

Sheffer

employees

would

receive

bonuses

due

to

tax

reform,

and

Wolf

Metals

in

Columbus

on

Friday,

where

new

investments

in

equipment

were

announced.

Also

this

week,

Portman

visited

Healing

Hearts

in

Mansfield

and

the

Alvis

House

in

Columbus

to

hear

from

those

battling

addiction

and

re-entering

society

from

the

criminal

justice

system—as

well

as

those

on

the

frontlines

working

to

assist

in

recovery

efforts.

Also

this

week,

Portman

introduced

the

Fallen

Warrior

Battlefield

Cross

Memorial

Act

to

help

ensure

that

veterans

buried

in

Ohio

and

around

the

country

can

be

properly

honored

with

the

Battlefield

Cross.

For

a

more

detailed

look

at

Senator

Portman’s

week,

please

see

the

following,

and,

in

case

you

missed

it,

here is

a

rundown

of

Senator

Portman’s

record

of

delivering

results

for

Ohioans

in

2017. results

Tuesday, January 2

Portman

Tours

Sheffer

Corporation

as

Employees

Receive

Bonuses

After

Tax

Reform

Bill

Signed

Into

Law

On

Tuesday,

Portman

visited

Sheffer

Corporation,

a

premier

cylinder

manufacturing

business

based

in

Cincinnati,

to

tour

the

facility,

meet

with

employees,

and

take

part

in

the

announcement

of

the

business’s

reinvestment

into

its

workers.

Sheffer

Corporation

announced

that

all

126

employees

will

be

given

$1,000

bonuses

with

the

money

the

business

expects

to

save

as

a

result

of

the

recently-signed

tax

reform

law.

“The

historic

tax

cuts

that

recently

became

law

are

already

helping

make

a

difference

for

middle-class

families,

creating

more

jobs,

and

increasing

wages

for

Ohio

workers,”

said

Portman.

“Providing

tax

relief

for

middle-class

families

and

reforming

our

business

tax

code

to

create

more

jobs

and

higher

wages

is

long

overdue,

and

I

was

proud

to

play

a

significant

role

in

helping

craft

this

law.

I’m

pleased

that

we’re

already

seeing

a

positive

response

as

employers

like

Sheffer

Corporation

reward

their

workers

with

higher

pay

and

bonuses—and

increase

their

investments

in

their

businesses

and

their

communities.

With

the

kinds

of

pro-growth

reforms

in

this

tax

reform

law,

I

expect

this

trend

to

continue

in

Ohio

and

across

the

country.”

“It

was

truly

an

honor

to

host

a

visit

today

from

Senator

Rob

Portman,”

said

Sheffer

Corporation

President

&

CEO

Jeff

Norris.

“Senator

Portman

along

with

his

colleagues

and

President

Donald

Trump

have

been

instrumental

in

bringing

forward

historic

and

new

tax

relief

for

American

companies

and

for

the

American

people.

For

many

years,

business

owners

have

voiced

concerns

about

the

burdens

associated

with

high

taxes

and

over-regulation.

It

is

my

hope

that

others

will

follow

and

show

support

for

Senator

Portman

and

President

Trump

as

they

fight

to

lower

our

tax

burdens

and

reduce

regulations.”

Photos

of

the

visit

can

be

found

here

and

excerpts

of

Cincinnati

TV

highlights

of

the

visit

can

be

found

here.

Portman

Visits

Healing

Hearts

in

Mansfield

Also

on

Tuesday,

Portman

visited

Healing

Hearts

in

Mansfield

where

he

heard

stories

of

recovery

and

met

with

those

on

the

frontlines

combating

addiction.

Said

Portman,

we

“must

continue

to

support

prevention,

education

and

treatment

in

our

communities,

and

we

must

continue

our

efforts

to

help

organizations

that

provide

treatment

and

assistance

to

those

in

need.

I’m

proud

of

the

work

that

they

are

doing

to

help

their

community.”Photos of the visit can be found here.

Portman

Statement

on

the

Retirement

Announcement

of

Senator

Orrin

Hatch

Portman

released

the

following

statement

on

the

retirement

announcement

of

Senate

Finance

Committee

Chairman

Orrin

Hatch

(R-UT):

“I

have

had

the

pleasure

of

working

with

Orrin

Hatch

over

the

years

on

many

issues,

including

anti-drug,

pension,

and

health

care

legislation,

both

in

the

Senate

and

during

my

tenure

in

the

House

of

Representatives.

In

addition,

I

was

honored

to

work

closely

with

him

in

my

role

as

U.S.

Trade

Representative to

open

up

markets

for

U.S.

products

and

services.

Most

recently,

I

was

privileged

to

work

closely

with

him

on

passing

historic

tax

reform

legislation

to

boost

our

economy,

create

jobs

and

raise

wages,

and

provide

a

more

level

playing

field

for

American

workers

and

businesses.

“Senator

Hatch

epitomizes

what

it

means

to

be

a

public

servant,

a

true

servant

leader

in

every

respect.

Over

the

years,

he

has

been

a

model

for

me

of

a

serious

legislator

who

reaches

across

the

aisle

and

focuses

on

delivering

results

that

will

help

the

people

we

represent.

Perhaps

most

importantly,

he

is

a

gentleman

who

treats

everyone

with

respect,

regardless

of

party.

I

look

forward

to

working

with

him

for

the

next

year,

and

Jane

and

I

wish

him,

Elaine,

and

his

family

the

best

in

the

future.”

Wednesday,

January

3

Portman,

Brown

Urge

Trade

Relief

for

Ohio

Whirlpool

Workers

Senators

Portman

and

Sherrod

Brown

(D-OH)

successfully

urged

the

International

Trade

Commission

(ITC)

to

rule

that

workers

at

Whirlpool’s

Clyde,

OH

plant

had

been

hurt

by

unfair

washing

machine

imports

by

Samsung

and

LG.

In

October,

the

ITC

made

a

determination

of

injury,

and

then

presented

a

list

of

recommended

remedies

to

Ambassador

Lighthizer.

As

Ambassador

Lighthizer

considers

those

recommendations,

the

Senators

are

asking

he

make

a

strong

recommendation

to

President

Trump

that

will

provide

broad

relief

for

the

U.S.

washing

machine

industry

in

response

serial

trade

violations

by

companies

like

LG

and

Samsung.

“We

are

pleased

to

see

the

ITC

find

that

there

has

been

injury

in

this

case,

and

that

the

ITC

agreed

that

there

should

be

no

product

exclusion

as

part

of

the

remedy,”

said

the

Senators

in

a

letter

sent

this

week

ahead

of

today’s

USTR

hearing.

“These

findings

form

the

basis

of

a

strong

remedy

that

helps

American

workers

and

communities,

like

Clyde,

continue

to

grow,

and

we

believe

that

with

the

inclusion

of

the

above

recommendations,

this

global

safeguard

action

will

be

a

success.

Ultimately,

a

strong

remedy

in

this

case

–

one

that

embraces

the

aforementioned

recommendations

–

will

provide

the

level

playing

field

that

lets

American

companies,

and

workers,

compete,

and

win.”

The

case

sought

broad

relief

for

the

U.S.

washing

machine

industry

in

response

to

the

pattern

of

violations

by

companies

like

LG

and

Samsung

who’ve

repeatedly

exported

their

washers

to

the

U.S.

at

unfair

prices.

Today,

Ambassador

Lighthizer

is

holding

a

hearing

to

determine

what

remedies

should

be

put

in

place

to

give

the

domestic

industry

the

relief

they

need

from

unfair

washer

imports.

He

will

then

make

a

recommendation

on

those

remedies

to

the

President.Portman and Brown both testified at ITC on behalf of Whirlpool, and urged ITC to take make a positive ruling.

Since 2012, Ohio’s Senators have fought against these unfair trade practices that have harmed Whirlpool, and most recently helped secure relief in a case against washing machine imports from China.

Portman and Brown worked to get the Leveling the Playing Field Act signed into law in June 2015, restoring strength to antidumping and countervailing duty statutes that allow businesses and workers in the United States to petition the Commerce Department and the ITC when foreign producers sell goods in the U.S. below market price or receive illegal subsidies. The law led to key wins for Ohio steel companies in major trade cases last year on cold-rolled, hot-rolled, and corrosion-resistant steel, including U.S. Steel, Nucor, ArcelorMittal, and AK Steel, which together employ more than 8,200 Ohio workers.

Read the full letter here.

Portman

&

Blumenthal

Announce

60

Bipartisan

Supporters

of

Stop

Enabling

Sex

Traffickers

Act

On

Wednesday,

Senators

Portman

and

Richard

Blumenthal

(D-CT)

announced

that

60

bipartisan

senators

now

support

the

Stop

Enabling

Sex

Traffickers

Act

(SESTA;

S.

1693). Three

more

cosponsors,

including

Senators

Mike

Rounds

(R-SD),

Richard

Shelby

(R-AL),

and

Pat

Roberts

(R-KS),

were

added

today. Portman

and

Blumenthal

issued

the

following

statement:

“Today

is

another

important

milestone

in

our

fight

to

hold

online

sex

traffickers

accountable

and

help

give

trafficking

survivors

the

justice

they

deserve.

There

continues

to

be

strong

bipartisan

support

and

momentum

for

this

bill,

and

behind

our

efforts

to

help

ensure

that

sex

traffickers

are

brought

to

justice.

In

recognition

of

the

president’s

declaration

of

January

as

National

Slavery

and

Human

Trafficking

Prevention

Month,

we

would

urge

the

full

Senate

to

take

up

and

pass

SESTA

as

quickly

as

possible.”

NOTE:

The

bipartisan

Stop

Enabling

Sex

Traffickers

Act

would

clarify

Section

230

of

the

Communications

Decency

Act

to

ensure

that

websites

that

knowingly

facilitate

sex

trafficking

can

be

held

liable

so

that

victims

can

get

justice.

The

Senate

Committee

on

Commerce,

Science

and

Transportation

approved

the

bill

unanimously

on

November

8. Since

its

introduction,

SESTA

has

earned

widespread

support

from

victims

and

advocates,

law

enforcement,

the

civil

rights

community,

faith-based

groups,

and

the

tech

community. Portman

and

Blumenthal

have

echoed

the

concerns

of

victims

advocacy

groups

who

have

said

that

the

House

Judiciary

bill

on

this

topic

is

harmful

to

efforts

to

protect

trafficking

survivors.Thursday, January 4

Portman

Introduces

Fallen

Warrior

Battlefield

Cross

Memorial

Act

On

Thursday,

Portman

introduced

the

Fallen

Warrior

Battlefield

Cross

Memorial

Act,

legislation

that

would

prevent

the

Department

of

Veterans

Affairs

from

denying

veterans

the

honor

they

have

earned

by

allowing

fallen

heroes

to

be

honored

at

their

gravesite

with

a

replica

of

the

Battlefield

Cross.

The

Battlefield

Cross

is

a

memorial

marker

typically

consisting

of

a

soldier’s

helmet,

rifle,

identification

tag,

and

pair

of

boots

that

serves

to

honor

and

respect

servicemembers

who

made

the

ultimate

sacrifice

for

our

country. Ohio

Rep.

Jim

Renacci

(R-OH)

has

introduced

companion

legislation

in

the

House

of

Representatives.

“We

owe

our

freedom

and

liberty

to

the

sacrifices

of

our

men

and

women

in

uniform,

and

nothing

should

get

in

the

way

of

honoring

those

who

have

made

the

ultimate

sacrifice

for

our

country,”

said

Portman.

“For

over

a

century,

the

Battlefield

Cross

has

memorialized

thousands

of

fallen

American

heroes

both

in

combat

zones

and

here

at

home,

and

this

honorable

tradition

must

be

allowed

to

continue.

I

am

pleased

that

the

Ohio

delegation

has

come

together

on

a

bipartisan

basis

to

help

ensure

that

veterans

buried

in

Ohio

and

around

the

country

can

be

properly

honored

with

the

Battlefield

Cross.

I

urge

the

Senate

to

pass

the

Fallen

Warrior

Battlefield

Cross

Memorial

Act.”

NOTE:

The

legislation

responds

to

a

2016

incident

at

Ohio

Western

Reserve

National

Cemetery

(OWRNC)

in

Rittman,

Ohio,

where

OWRNC

administrators

infuriated

veterans

by

removing

a

battlefield

cross

replica

from

the

cemetery.

The

replica

was

replaced

soon

after

Portman

and

Congressman

Renacci’s

(R-OH)

office

got

involved.

The

measure

is

supported

by

the

entire

Ohio

congressional

delegation.

On

CNBC,

Portman

Discusses

the

Positive

Impact

of

Tax

Reform

on

Ohio

During

an

interview

on

CNBC’s

Squawk

Box,

Senator

Portman

discussed

how

the Tax

Cuts

&

Jobs

Act

is

already

paying

dividends

for

Ohio’s

workers.

Portman,

who

played

a

key

role

in

passing

the

historic

tax

cuts

that

will

help

the

middle

class,

create

jobs,

and

boost

wages

for

American

workers,

highlighted

how

numerous

Ohio

businesses,

such

as

Sheffer

Corporation

in

Cincinnati

where

he visited earlier

this

week,

have

already

announced

bonuses

for

their

workforce

and

new

investments

in

their

plants

and

equipment.Excerpts of the interview can be found here and a video can be found here.

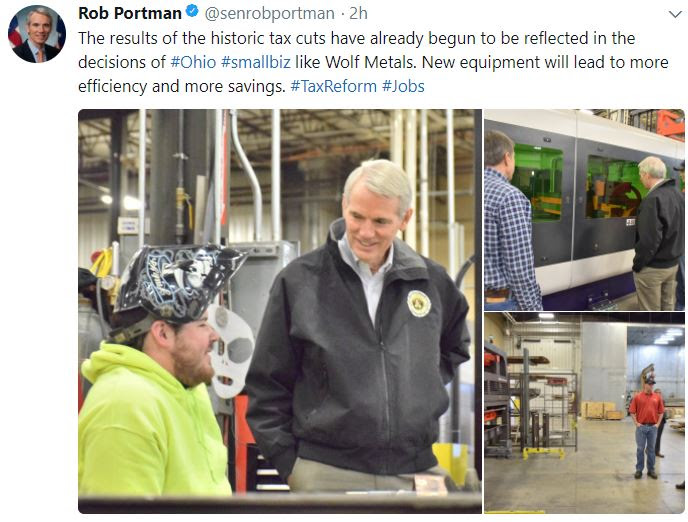

Friday,

January

5

Portman

Tours

Columbus

Business

Announcing

New

Investments

in

Equipment

After

Tax

Reform

Bill

Signed

Into

Law

On

Friday,

Portman

visited

Wolf

Metals

in

Columbus

as

part

of

his

Results

for

the

Middle

Class

Tax

Reform

Tour.

Wolf

Metals

is

a

small,

family-run

metal

manufacturing

company

that

has

been

operated

by

the

Wolf

family

for

more

than

four

decades.

Portman

toured

the

facility,

met

with

employees,

and

took

part

in

the

announcement

of

the

business’

plan

to

purchase

new

equipment

as

a

result

of

the

recently

signed

into

law

Tax

Cuts

&

Jobs

Act.

Plant

ownership

expects

employees

to

get

bonuses

based

on

the

use

of

the

new

and

more

efficient

machines.

“The

results

of

the

historic

tax

cuts

have

already

begun

to

be

reflected

in

the

decisions

of

Ohio

small

businesses

like

Wolf

Metals.

This

will

help

make

a

real

difference

for

middle-class

families,”

said

Portman.

“Providing

tax

relief

for

middle-class

families

and

reforming

our

business

tax

code

to

create

more

jobs

and

higher

wages

is

long

overdue,

and

I

was

proud

to

play

a

significant

role

in

helping

craft

this

law.

I’m

pleased

that

we’re

already

seeing

a

positive

response

as

employers

like

Wolf

Metals

invest

more

in

their

businesses

and

their

communities.

With

the

kinds

of

pro-growth

reforms

in

this

tax

reform

law,

I

expect

more

and

more

companies

to

respond

by

announcing

wage

increases,

bonuses,

higher

401(k)

matches,

and

more

investment

in

plants

and

equipment.

This

investment

isn’t

just

important

for

the

company

and

the

workers

it

employs,

but

also

for

their

surrounding

communities

and

the

economy

as

a

whole.”

“Today,

as

a

result

of

the

new

tax

reform

law,

Wolf

Metals

was

proud

to

announce

its

plan

to

purchase

new

equipment,

including

a

water

jet

cutter

first

and

then

a

press

brake,” said

Jim

Wolf,

Co-Founder

and

Owner.

“This

investment

will

help

our

company,

help

our

workers,

and

help

those

who

rely

on

us

to

deliver

top-of-the-line

product.

I

want

to

thank

Senator

Portman

for

coming

to

visit

today

and

for

his

role

in

delivering

historic

tax

relief

for

small

businesses

like

ours

who

for

too

long

have

been

saddled

with

burdensome

taxes

and

over-regulation.”

Photos

of

the

event

can

be

found

here.

Portman

Tours

Alvis

Pages

Treatment

Center

in

Columbus

Friday

afternoon,

Portman

visited

Alvis

Pages

Treatment

Center

in

Columbus

to

tour

the

facility

and

meet

with

staff

and

patients.

Alvis

is

a

nonprofit

human

services

agency

with

50

years

of

experience

providing

highly

effective

re-entry

treatment

programs

for

individuals

who

have

spent

time

in

the

criminal

justice

system.

Alvis

has

grown

from

a

single

15-bed

home

helping

60

men

a

year

to

an

organization

with

13

locations

throughout

Columbus,

Chillicothe,

Dayton,

Lima

and

Toledo

that

now

serves

more

than

8,000

people

annually.

“I

had

a

great

visit

at

Alvis

Pages

Treatment

Center

in

Columbus.

I’ve

had

the

privilege

of

working

closely

with

Alvis

as

they

have

become

a

model

for

re-entry

and

treatment

service

programs.

When

I

talk

to

the

people

who

work

at

Alvis,

or

those

they

are

helping,

it

is

clear

that

their

method

to

turn

lives

around

180

degrees

is

working.

I’m

pleased

that

they

have

benefited

from

the

Second

Chance

Act,

which

I

authored,

and

the

Work

Opportunity

Tax

Credit,

which

I

fought

to

preserve

in

the

recent

tax

reform

law.

I

was

proud

to

once

again

see

the

great

work

this

organization

is

doing

and

to

honor

them

on

the

Senate

floor

last

month,

recognizing

their

50-year

anniversary—and

many

more

successful

years

to

come.”

NOTE:

Portman

recognized

Alvis’

50-year

anniversary

in

a

speech

on

the

Senate

floor

last

month.

Last

year,

Alvis

was

awarded

a

$1.5

million

grant

from

Portman’s

Second

Chance

Act.

Alvis

also

benefits

from

provisions

Portman

fought

to

keep

in

the

final

version

of

the

Tax

Cuts

and

Jobs

Act,

and

plans

on

applying

for

grant

funding

next

year

through

Portman’s

Comprehensive

Addiction

&

Recovery

Act.Photos of the event can be found here.

On Social Media

Chillicothe families get tax help, job opportunities, higher wages from tax bill

The new year is a chance for many people to reflect, improve, and plan for the future. Thanks to the tax reform legislation that recently became law, the new year also provides the opportunity to keep more of your own hard-earned money rather than it going to Washington. And it is also helping the economy overall as Ohio companies raise wages, pay bonuses, increase investments in plant and equipment, or boost their 401(k) match. We are already seeing a positive impact.

The Tax Cuts and Jobs Act, which President Trump signed into law just before Christmas, will provide tax relief for Chillicothe families who for the past decade or more have felt the middle-class squeeze of higher expenses — healthcare being the biggest expense — and flat wages. The law lowers tax rates for Ohio families, doubles the standard deduction to $24,000 per family, and doubles the child tax credit to $2,000 per family.

In total, the tax cuts in this plan will take more than three million people who currently have federal income tax liability off the tax rolls altogether. And a typical family of four at the median income level can expect to keep an extra $2,000 of their hard-earned money in their pockets every April instead of it going to their federal taxes. An extra $2,000 can make a big difference if you’re living paycheck-to-paycheck, as a lot of people are. That money can help pay for health care or a car payment or can be put away to save for retirement….

(“Chillicothe families get tax help, job opportunities, higher wages from tax bill,” Rob Portman. Chillicothe Gazette. January 5, 2017)

Ohio Senator says tax bill provides immediate relief

Republicans in Congress have been taking a victory lap on the passage of their tax reform legislation.

One of GOP leaders who fought hard for the bill was Ohio Senator Rob Portman…

Portman is confident the now-passed tax reform will start to reverse that trend in 2018. And it starts with more take-home pay.

“Most people will see that in their paychecks, probably starting in February, because they'll see the withholding from Uncle Sam is less,” Portman said. “In other words, more money going to them and less to the government."

That's one prong of the now-passed legislation. But, according to tax experts, the tax law was written with a bigger emphasis in mind.

"We want American businesses to be more competitive, and so we did we lower the business tax rate, which was the highest in all of the industrialized world," Portman said.

"That's what you see happening right now: a lot of businesses are saying, 'You know what, I'm going to see some tax benefit here. I'm going to make sure my employees are able to share in that," Portman said.

(“Ohio Senator says tax bill provides immediate relief,” David Singer. Steubenville WTOV. January 4, 2017)

Rob Portman Visits Healing Hearts In Mansfield

US Senator Rob Portman (R-OH) visited Healing Hearts in Mansfield Tuesday afternoon to discuss issues relating to the opiate crisis.

Local healthcare and counseling professionals such as Joe Trolian, Executive Director of the Richland County Mental Health and Recovery Services Board, took part in the discussion. Several Healing Hearts clients and staff members who have seen addiction firsthand were in attendance.

Portman and the assembled group discussed topics such as relapses and various ways to prevent them, filling gaps in the recovery process from a healthcare standpoint, and how to stem the tide of opiate abuse and addiction in the community…

(“Rob Portman Visits Healing Hearts In Mansfield,” Staff. Mansfield WMFD. January 2, 2018)

Tech Firms Drawn Into Lawmakers’ Battle Over Deterring Online Sex Trade

A dispute over how to deter a flourishing online sex trade is likely to escalate into a high-profile policy battle in 2018, adding to political headaches for big tech.

Sen. Rob Portman (R., Ohio), one of the main sponsors of the Senate bill, said his approach is “the right prescription for solving this problem, and I am confident the full Senate will pass it in an overwhelming, bipartisan fashion.”

Aides expect the Portman bill, also backed by Sen. Richard Blumenthal (D., Conn.) and more than 50 other senators, to reach the Senate floor early next year, and be approved by a big margin. Advocates also have been planning events for January to raise public awareness…

(“Tech Firms Drawn Into Lawmakers’ Battle Over Deterring Online Sex Trade,” John McKinnon. Wall Street Journal. December 29, 2017)

Ohio Senators looking forward to 2018

With a new year comes new opportunities to get things done - whether those are new challenges or old issues - and it's no different in Washington…

Senator Rob Portman is looking forward to possible changes with infrastructure and job training to help make sure that people are able to do and keep their jobs.

"I’d like to combine work re-training programs because frankly, if we did a big infrastructure program in this country, we need workers for us to do it, and so I think working retraining goes a long way with that," said Sen. Portman. "We need to get people who are not in the workforce at all and help them get the skills that they need to be able to have a good job and to be able to get the dignity and self respect that comes from working - that’s one of my big pushes."

(“Ohio Senators looking forward to 2018,” Katie Honigford. Lima Hometown Stations. December 31, 2017)

Sen. Rob Portman: New tax law took US corporate tax code from worst to 'one of the best'

Some corporations have reacted to the passage of sweeping tax reform legislation by announcing stock buybacks, raising wages or planning to give bonuses. Sen. Rob Portman, R-Ohio, says the best news is yet to come.

"I've talked to a number of CEOs over the past several months about the tax reform as it relates to international business. They can now be competitive here in America," Portman told CNBC's "Squawk Box" on Thursday.

"I think you'll see some big news coming up as to companies that are literally moving factories from overseas back to the United States," he said…

(“Sen. Rob Portman: New tax law took US corporate tax code from worst to 'one of the best',” Kevin Breuninger. CNBC. January 4, 2017)

No comments:

Post a Comment

The South Central Bulldog reserves the right to reject any comment for any reason, without explanation.